5 Tax Mistakes Short-Term Rental Hosts Should Avoid (and What to Do Instead)

Taxes and short-term rentals — they don’t have to be scary, but they do require strategy. Whether you’re managing your own property or working with a team, understanding the tax landscape of short-term rentals (STRs) can save you thousands of dollars each year.

In this post, we’re breaking down 5 common tax mistakes STR hosts make, plus what to do instead — based on our experience as STR business owners and advice from CPA and tax strategist Amanda Han of Keystone CPA.

📥 Download our free STR Tax Cheat Sheet

👩💼 Connect with Amanda Han

Mistake #1: Misclassifying Your Rental Income

Many hosts assume STR income is passive like long-term rentals — but the IRS views short stays differently. This is good news!

If your average guest stay is 7 days or less, and you don’t provide daily services (like meals or daily cleaning), your STR can be treated like an active business. That means you may be able to offset W-2 income using STR-related losses like depreciation, repairs, and expenses.

The takeaway:

Track your average guest stay and how involved you are in the business. If you’re offering hospitality, not hotel-style services, you could qualify for huge tax benefits.

Mistake #2: Failing to Track Material Participation

To use STR losses to offset W-2 income, you need to show material participation.

You must either:

- Spend 500+ hours on the property, OR

- Spend 100+ hours AND more than anyone else who helps you manage the property.

Track your time: guest messaging, supply orders, maintenance — it all adds up. Keep a log that can be verified in case of an audit.

Bonus tip: This strategy is especially valuable for high W-2 earners. With proper participation and documentation, you could reduce your taxable income significantly.

Mistake #3: Ignoring Depreciation Deductions

Your property may be going up in value, but you can still depreciate it in the eyes of the IRS. That’s a huge win for STR hosts.

Plus, if you make upgrades like new flooring, furniture, or appliances, you may qualify for bonus depreciation — especially for improvements made from the drywall in.

What to do:

Work with a tax professional to set up a depreciation schedule and keep records of all improvements, expenses, and receipts.

Mistake #4: Not Reporting Personal Use Correctly

If you or your family use the property for personal stays, it affects your deductions. The IRS allows:

- 14 days of personal use OR

- 10% of your total rental days (whichever is greater)

Exceed that, and you may not qualify for all your deductions.

Pro tip: Track every single stay — personal or guest — in a calendar or spreadsheet. This will also help you calculate lost revenue from owner stays.

Mistake #5: Overlooking State & Local Taxes

Your federal tax strategy is important — but don’t ignore local obligations. Depending on your market, you may owe:

- Occupancy taxes

- Sales taxes

- Tourism taxes

Platforms like Airbnb may collect and remit some of these, but not always — and not everywhere. You are responsible for knowing what applies to your listing.

What to do:

Check with your local city, county, and state offices. Use tools like Avalara’s MyLodgeTax to help automate compliance. And again — talk to your CPA.

Final Thoughts: Get Proactive About Your Taxes

There’s a reason so many investors love STRs — the potential tax benefits can be powerful. But you need to understand how they apply to you and your market.

✅ Track guest stays

✅ Log your time

✅ Know your local rules

✅ Work with a short-term rental–savvy CPA

Download a transcript of this episode.

Resources:

- Hostfully | Use Code TFV200 for $200 off!

- Minoan | Visit MinoanExperience.com and tell them TFV sent you!

- Tax advisor specializing in STR and real estate investors | Connect with Amanda Han

- Download our STR Host Tax Cheat Sheet

- 6 Ways to Use ChatGPT in Your Airbnb Business | Subscribe to our YouTube Channel

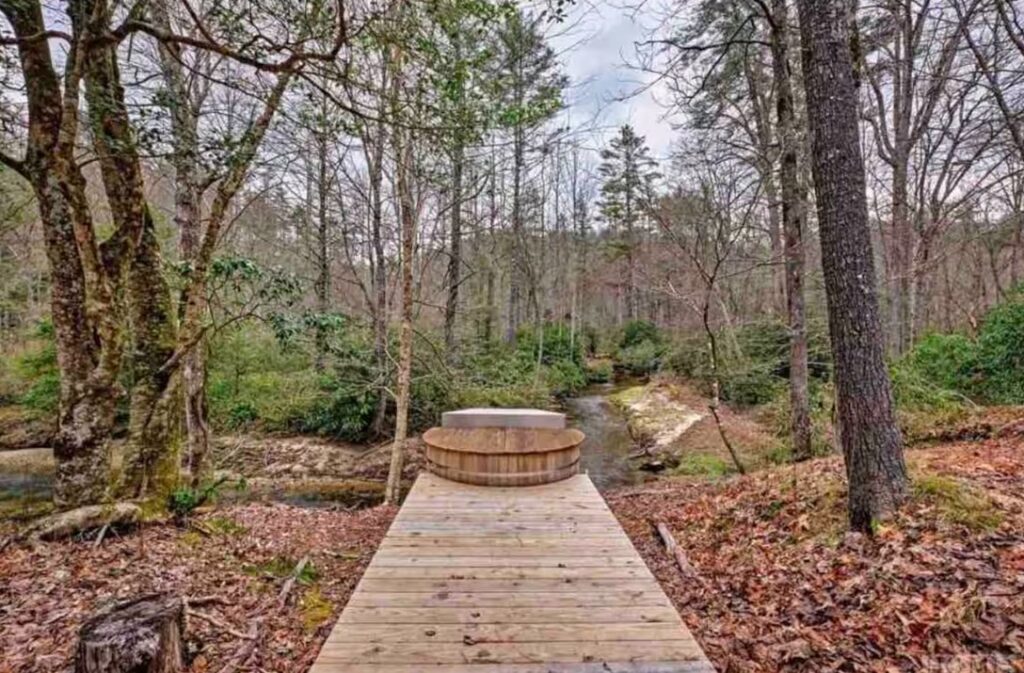

- #STRShareSunday: @fowlercreekcabin

- Submit your property for our next #STRShareSunday at strshare.com

#STRShareSunday

Nestled along Fowler Creek in Cashiers, NC, this custom-built cabin is the perfect spot to unwind. Completed in 2018, the home features beautiful hardwood floors, wood harvested from the property, and a cozy wood-burning stove. With three bedrooms, two baths, a wood-fired hot tub, and fiber internet, it’s a great mix of rustic charm and modern convenience. Enjoy trout fishing right in the backyard, sip coffee on the covered porches, or explore the nearby hiking trails, golf courses, and lakes. Follow @fowlercreekcabin to plan your next mountain getaway!

We would love to feature YOU! Submit your property for our next #STRShareSunday at strshare.com.

show comments

Hide comments